Taxes and Your Divorce: 5 Effects You Need to Know About

When getting a divorce, you may have a variety of financial matters to figure out. One financial element that many couples fail to fully understand is the impact of the divorce and its settlement on income taxes. How could your taxes look different after a divorce? Discover a few key things to watch out for.

1. Income Changes

One of the biggest changes for divorcing couples is their taxable income going forward. This is also one of the longest-lasting tax changes.

If you were a two-income household, for instance, you will likely now become a single-income household. This alters not only how much you are taxed but how it is taxed. You may find yourself in a different tax bracket — possibly higher but usually lower — facing a different percentage of income tax per dollar earned. Your new income levels may qualify you for certain tax credits or make you ineligible for others.

2. Capital Gains Tax

The divorce settlement divides up marital assets, some of which can have significant value. The family home, for instance, often has thousands — or even hundreds of thousands — of dollars in equity within it. If you receive the house in the settlement and later sell it, you may be subject to capital gains tax. Even the standard tax exclusion for a primary house may not be sufficient if the home appreciates in value.

Capital gains tax affects the sale of any significant investment. This includes marital assets ranging from a family business to your spouse's baseball card collection. The tax itself also carries different rates based on your income and the type of investment you sell. Only by understanding how each item would be subject to capital gains can you choose which mix of investments actually achieves a fair settlement.

3. Lump Sum Payments

Money transferred between spouses may or may not be subject to taxes. If you must liquidate an asset in order to divide it, that liquidation could be a taxable event. For instance, liquidating a retirement account even under a divorce decree may include additional taxes and penalties for early withdrawal.

One of the biggest lump sum payment issues is the sale of the family business. Because this can generate such a large sale price, many spouses may need to negotiate tax strategies like using an installment agreement for several years rather than a lump sum in one.

Because lump sum payments can have such large tax effects, deferral is a common solution. If you will get more than one large taxable sum, such as an asset and a lump sum payment in lieu of alimony, deferring one sum to one or more additional years can help in many ways. This includes allowing you to qualify for credits or deductions, maintaining a lower tax bracket, and avoiding higher capital gains rates.

4. Investment Account Types

When you receive different types of assets — particularly investments — in the settlement, they may be in different forms than before. You may opt to invest an account in traditional stocks rather than tax-advantaged bonds, for instance. This alters the way this money will be taxed.

Similarly, if you receive a portion of your spouse's retirement accounts in the settlement, you must follow the rules for this transfer in order to avoid turning it into a taxable event. Failure to do so within the prescribed time and in the right type of account — even something as detailed as a traditional IRA or a Roth IRA — could cause a big tax bill.

5. Deduction Changes

Along with different taxable income, you will also face different tax deductions and credits. Parents of college-aged children or younger may address in their divorce decree who will claim the children in different tax years. Custody and expenses for the child also affect who can claim the deduction as well as child tax credits. Many such tax credits — like the Earned Income Tax Credit — have their own unique rules.

Other tax deductions in which you may see a difference include itemized deductions involving the marital home or property taxes, deductions for higher education expenses, and even children's medical expenses. Your ability to claim education or medical expenses may depend on who claims the child as a dependent or who pays for the majority of their costs (which may be different than custody).

Where Should You Start?

The tax effects of divorce are far-reaching and complicated. And few divorcing couples come into the process with a full understanding of how all these work. Your best bet to determine the consequences of your particular divorce negotiations is to work with an experienced divorce attorney in your state.

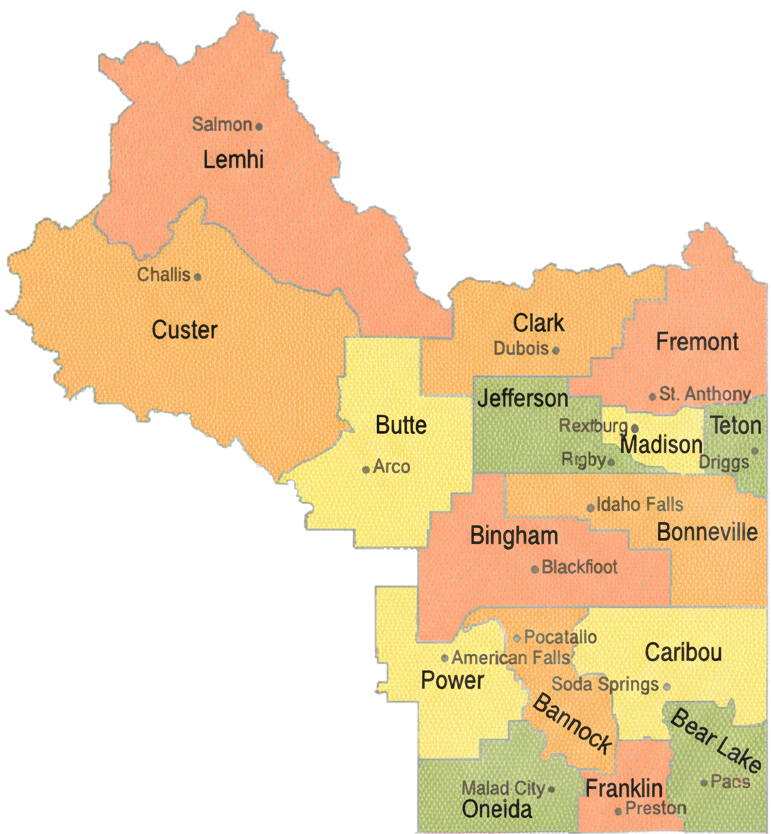

Idaho residents have relied on Hart Law Offices, P.C., for more than 40 years. You can too. Call today to make an appointment with our legal team. We look forward to helping you.